UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to sec. 240.14a-12 |

CORNERSTONE CORE PROPERTIES REIT, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Cornerstone Core Properties REIT, Inc.

1920 Main Street, Suite 400

Irvine, CA 92614

Proxy Statement and

Notice of Annual Meeting of Stockholders

To Be Held June 21, 2012May 16th, 2013

Dear Stockholder:

We cordially invite you to attend the 2012 annual meeting2013 Annual Meeting of stockholdersStockholders of Cornerstone Core Properties REIT, Inc., to be held on Thursday, June 21, 2012,May 16, 2013, at 10:00 a.m. local time at our corporate offices located at 1920 Main Street, Suite 400 in Irvine, California 92614. Directions to the annual meeting can be obtained by calling (877) 805-3333or visitingwww.crefunds.com.

We are holding this meeting to:

| 1. | Elect |

The Board of Directors recommends a vote FOR each nominee

| 2. | Attend to such other business as may properly come before the meeting and any adjournment or postponement thereof. |

Your Board of Directors has selected March 29, 2012April 1, 2013 as the record date for determining stockholders entitled to vote at the annual meeting.

The proxy statement, proxy cardProxy Statement, Proxy Card and our 2011 annual report2012 Annual Report to stockholdersStockholders are being mailed to you on or about April 10, 2012.9, 2013.

Whether you plan to attend the meeting and vote in person or not, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the internet; (2) by telephone; or (3) by mail, using the enclosed proxy card.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MAY 16, 2013: |

| Our https://www.proxy-direct.com/ Thank you for your support of Cornerstone Core Properties |

| Sincerely, | |

| April 9, 2013 |  |

| Irvine, California | President and Chief |

| 1 |

CORNERSTONE CORE PROPERTIES REIT, INC.

1920 Main Street, Suite 400

Irvine, California 92614

PROXY STATEMENT

20122013 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELDJUNE 21,2012MAY 16, 2013

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of Cornerstone Core Properties REIT, Inc. (“Cornerstone Core Properties REIT,” “we,” or “us” or the “Company”), a Maryland corporation, of proxies for use at the 2012 annual meeting2013 Annual Meeting of stockholdersStockholders (the “Annual Meeting”) to be held on June 21, 2012,May 16, 2013, at 10:00 a.m. local time at our executive offices, 1920 Main Street, Suite 400, Irvine, California 92614, and at any adjournment or postponement thereof, for the purposes set forth in the Notice of Annual Meeting of Stockholders.

This proxy statement,Proxy Statement, form of proxy and voting instructions are first being mailed or given to stockholders on or about April 10, 2012.9, 2013.

Stockholders Entitled to Vote

Holders of our common stock at the close of business on March 29, 2012April 1, 2013 (the “Record Date”) are entitled to receive notice of and to vote their shares at the annual meeting.Annual Meeting. As of the Record Date, there were 23,028,285 shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the annual meeting.Annual Meeting.

| HOW TO VOTE IF YOU ARE A STOCKHOLDER OF RECORD: |

| For those stockholders with |

| Voting by proxy will not limit your right to vote at the Annual Meeting. |

| All proxies that have been properly authorized and not revoked will be voted at the |

| Your vote is important. You can save the expense of a second mailing by voting promptly. |

Required Vote

The presence, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote at the annual meetingAnnual Meeting is necessary to constitute a quorum. If a share is represented for any purpose at the annual meeting,Annual Meeting, it is deemed to be present for quorum purposes and for all other purposes as well. A stockholder may withhold his or her vote in the election of directors or abstain with respect to each other item submitted for stockholder approval. Withheld votes and abstentions will be counted as present and entitled to vote for purposes of determining the existence of a quorum. Withheld votes in the election of directors and abstentions in all other items submitted for stockholder approval will not be counted as votes cast.

Election of Directors.A majority of the votes present in person or by proxy at the meeting is required for the election of the directors. This means that a director nominee needs to receive more votes for his election than against his election in order to be elected to the board.Board. Because of this majority vote requirement, withheld votes will have the effect of a vote against each nominee for director. As described in more detail below, broker non-votes will also have the effect of a vote against each nominee for director.

Other Matters.Our Board of Directors does not presently intend to bring any business before the annual meetingAnnual Meeting other than the proposals that areproposal identified in the Notice of Annual Meeting of Stockholders and discussed in this proxy statement.Proxy Statement. If other matters are properly presented at the annual meetingAnnual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. As of the date of this Proxy Statement, we did not know of any other matters to be raised at the annual meeting.Annual Meeting.

Broker Non-Votes

A broker that holds shares in “street name” generally has the authority to exercise its discretion and vote on routine items when it has not received instructions from the beneficial owner. A broker that holds shares in “street name” does not have the authority to vote on non-routine items when it has not received instructions from the beneficial owner. A vote for the election of directorsis considered a non-routine matter,matter; therefore, absent your instructions, a broker that holds your shares in “street name” will not be permitted to vote your shares in the election of any nominee for director. If the broker returns a properly executed proxy, the shares are counted as present for quorum purposes. If a broker returns a properly executed proxy, but crosses out non-routine matters for which you have not given instructions (a so-called “broker non-vote”), the proxy will have the same effect as a vote AGAINST“AGAINST” the election of each of the three nominees named herein.

Revocation of Proxies

You can revoke your proxy at any time before it is voted at the annual meetingAnnual Meeting by:

| · | providing written notice of such revocation to our |

| · | signing and submitting a new proxy card with a later date; |

| · | authorizing a new proxy by telephone or Internet (only your latest proxy is counted); or |

| · | voting your shares in person at the |

Proxy Solicitation

The solicitation of proxies for the annual meetingAnnual Meeting will be made primarily by mail. However, if necessary to ensure satisfactory representation at the annual meeting,Annual Meeting, we may also solicit proxies by telephone or in person. We have engaged Computershare Fund Services to assist with the solicitation of proxies in conjunction with the annual meeting.Annual Meeting. We anticipate that the aggregate fees for these services will be between $30,000 and $35,000. However, the exact cost will depend on the amount and types of services rendered.We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of our common stock. Our executive officers and regular employees of Cornerstone Realty Advisors, LLC, our advisor (the “Advisor”), or its affiliates may also solicit proxies, but they will not be specifically compensated for these services. The costs of the proxy solicitation will be borne by us.the Company.

| 3 |

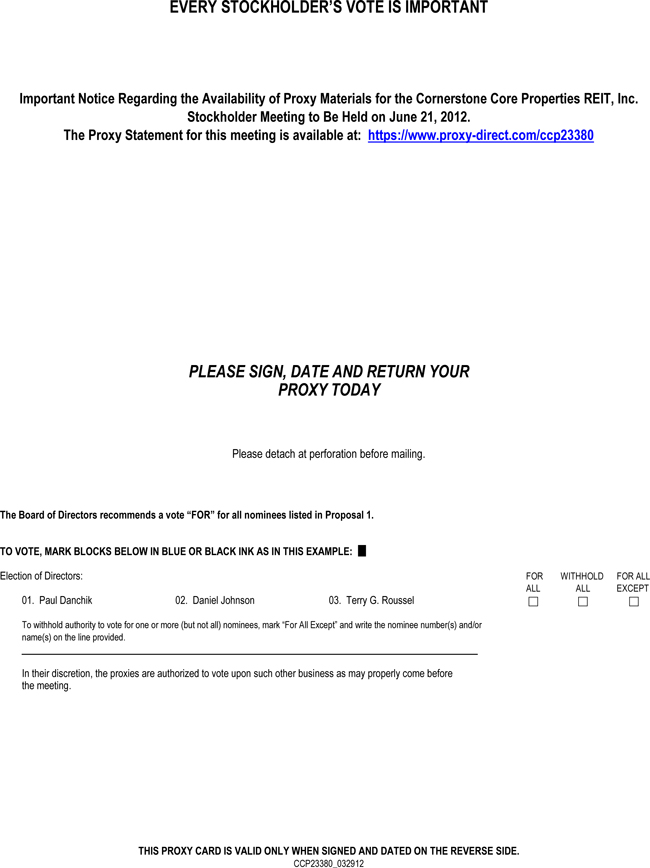

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors currently consists of threetwo members, two of whom (PaulPaul Danchik and Daniel Johnson)Johnson, both of whom have been determined by the Board of Directors to be “independent” as that term is defined under our charter, the NASDAQ ruleslisting standards and the rules of the SEC.U.S. Securities and Exchange Commission (the “SEC”). The Board of Directors has proposed the following nominees for election as directors, each to serve for a one year term ending at the 2013 annual meeting2014 Annual Meeting of stockholders: Terry Roussel,Stockholders: Paul Danchik and Daniel Johnson. Each nominee currently serves as a director, and, if re-elected, will continue in office until his successor has been elected and qualified, or until his earlier death, resignation or retirement.

We expect each nominee standing for electionre-election as a director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board of Directors chooses to reduce the number of directors serving on the Board of Directors.Board.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL NOMINEES TO BE ELECTED AS DIRECTORS

The principal occupation and certain other information about the nominees are set forth below.

Terry G. Roussel,Paul Danchik, age 58, is one of the founders of the Cornerstone-related entities that commenced operations in 1989. Mr. Roussel founded our business and has been our President and Chief Executive Officer and one of our directors since October 2004. Mr. Roussel is the Chief Executive Officer and a Director of Cornerstone Realty Advisors, LLC, our advisor, a position he has held since July 2005. Mr. Roussel is also the President, Chief Executive Officer, a Director and the majority shareholder of Cornerstone Ventures, Inc., an affiliate of our advisor. Since October 2006, Mr. Roussel has been the President and Chief Executive Officer of Cornerstone Leveraged Realty Advisors, LLC. From October 2006 through May 2011, Mr. Roussel served as the President, Chief Executive Officer and Chairman of the Board of Directors of Cornerstone Healthcare Plus REIT, Inc. Mr. Roussel served as a director of Cornerstone Healthcare Plus REIT, Inc. from October 2006 until July 2011. Mr. Roussel is also the majority shareholder of Pacific Cornerstone Capital, Inc., which served as the dealer-manager for our offerings of securities. Under Mr. Roussel’s direction, Cornerstone and its affiliates formed ten separate real estate investment funds and joint ventures. In 1993, Cornerstone and its affiliates became managing joint venture partner with Koll Capital Markets Group, Inc., a wholly owned subsidiary of Koll Management Services, Inc. (now owned by CB Richard Ellis).

As managing partner of the above-described funds and joint ventures, Cornerstone and its affiliates were responsible for the acquisition, operation, leasing, and disposition of all jointly-owned properties between Cornerstone and Koll. In connection with acquiring properties for the account of these joint ventures, Mr. Roussel personally supervised the acquisition of each property, initiated and directed the business plan for each property, and arranged debt and equity financing for the acquisition of each property.

In 1985, Mr. Roussel started the Special Investments Group, a new division within Bank of America’s Capital Markets Group which provided real estate investment opportunities to the bank’s wealthiest private banking clients. Between 1980 and 1985, Mr. Roussel was employed by Bateman Eichler, Hill Richards, Inc., a regional securities firm headquartered in Los Angeles, California. In this capacity, Mr. Roussel was promoted to First Vice President and Manager of the partnership finance department where he was responsible for the due diligence and marketing of all publicly-registered real estate funds offered by the firm.

Mr. Roussel graduated with honors from California State University at Fullerton in 1976 with a B.A. in Business Administration with a concentration in Accounting. Subsequent to graduation, Mr. Roussel joined the accounting firm of Arthur Andersen & Co. as an auditor and later transferred to the tax department of Arthur Young & Co., the predecessor firm to Ernst & Young. Mr. Roussel became a Certified Public Accountant in 1979.

On December 11, 2009, Mr. Roussel and Pacific Cornerstone Capital, Inc. entered into a Letter of Acceptance, Waiver and Consent (AWC) with the Financial Industry Regulatory Authority (FINRA) relating to alleged rule violations. The AWC set forth FINRA’s findings that Pacific Cornerstone Capital and Mr. Roussel had violated conduct rules in connection with private placements conducted by Pacific Cornerstone Capital during the period from January 1, 2004 through May 30, 2009. Without admitting or denying the allegations and findings against them, Pacific Cornerstone Capital and Mr. Roussel consented in the AWC to various findings by FINRA, which allege that they violated NASD and FINRA rules relating to communications with the public (NASD Rule 2210); supervision (NASD Rule 3010), and standards of commercial honor and principles of trade (FINRA Rule 2010, formerly NASD Rule 2110). FINRA’s allegations, in sum, focus on claimed material misstatements and omissions with respect to certain performance targets used in connection with the private placements. Pacific Cornerstone Capital consented to a censure and fine of $700,000. Mr. Roussel consented to a fine of $50,000, suspension from association with a FINRA member in all capacities for 20 business days, and suspension from association with a FINRA member firm in a principal capacity for an additional three months.

For the following reasons, the board concluded that Mr. Roussel should serve as a director. As the Chief Executive Officer and President of the company, Mr. Roussel is the only officer of the company to sit on the Board of Directors. As such, Mr. Roussel is well positioned to provide essential insight and guidance to the Board of Directors from an inside perspective of the day-to-day operations of the company. Furthermore, as one of the founders of the Cornerstone-related entities in 1989, Mr. Roussel brings critical and extensive experience in sponsoring real estate investment programs and in supervising all phases of their operations, including capital raising, property acquisitions, financings, operations, leasing, asset management and dispositions. His experience with complex financial and operational issues in the real estate industry, as well as his strong leadership ability and business acumen make him critical to proper functioning of the Board of Directors.

Paul Danchik, age 61,62, retired in 2003 as Senior Vice President for Warner Media Services, a division of Time Warner, Inc. Mr. Danchik was a member of the Executive Management Team of Warner Media Services and was responsible for their Consumer Products Division with a strong emphasis onwhich also included managing a national sales group. Mr. Danchik began his career with Ivy Hill Packaging in 1973, which was acquired by Time Warner, Inc. in 1989. From 2005-2009, Mr. Danchik served in various development roles for Acres of Love, a non-profit organization licensed in the Republic of South Africa that operates homes to rescue and care for abandoned and orphanedvulnerable children living with or affected by HIV/AIDS. From 2006-2009,AIDS, and Mr. Danchik also acted as a consultant handling strategic business planning and organizational issuescurrently serves on behalfthe Acres of the Life Church in Irvine, California. In 2010, Mr. Danchik joined High Tower, a commercial real estate firm specializing in church properties.Love Board of Directors. Mr. Danchik earned a Bachelor of Science Degree in Business Administration from the University of LaVerne.La Verne and graduated from the Master’s Program, an executive leadership course. Mr. Danchik also holds a current California State Real Estate license. .

For the following reasons, the boardThe Board concluded that Mr. Danchik should continue to serve as a director.director of the Company for the following reasons. Mr. Danchik brings to the Board of Directors over 30 years of demonstrated management ability, and he is a well-rounded business executive with financial, legal, sales and operations exposure at senior levels. In particular, Mr. Danchik’s in-depth experience in the fields of corporate sales and sales management provides the boardBoard with valuable insight related to the company’sCompany’s capital raising efforts. Mr. Danchik also has extensive board service experience. His service on our Board of Directors since 2006 provides him with knowledge and perspective regarding our operations and investments. In addition, he has served on the boards of directors for several non-profit organizations and has participated in a number of formal seminars designed to promote effective board governance skills. In the course of his career, Mr. Danchik has cultivated strong communication and consensus building skills, which are assets to our board.Board.

Daniel Johnson, age 56,57, served until 2008 as the Senior Vice President of Sales for InfoSpan, Inc., a company that he co-founded in 2003 to develop and operate customer interaction centers for U.S.- and Canadian-based corporations. InfoSpan conducts operations in Mexico, Canada and the Indian sub-continent. From 2000 to 2003, Mr. Johnson was the President of Rutilus Software, Inc. a developer of disk-based storage software. Prior to 2000, Mr. Johnson spent 14 years with Toshiba America where he was Vice President of OEM Sales. In this capacity he was responsible for worldwide sales for products within his Division of Toshiba America. Mr. Johnson earned a Bachelor of Arts degree from Southern Illinois University.

For the following reasons, the boardThe Board concluded that Mr. Johnson should continue to serve as a director.director of the Company for the following reasons. Mr. Johnson’s 25 years of corporate and entrepreneurial experience in sales, customer service and operations in the U.S.United States and abroad provide the board with valuable insight in the area of capital raising, which is critical to our company’sCompany’s success. Mr. Johnson is also able to apply knowledge and perspective developed through years of experience with developing, evaluating and executing business plans and strategy in a diverse range of business contexts, from startups to large corporations. Furthermore,Mr. Johnson’s management and entrepreneurial experience provide our board with communication and relationship-building skills that are critical to the smooth functioning of our board.valuable strengths.

Board Leadership Structure

Our company is led byIn January and April 2012, respectively, Messrs. Lee Stedman and Jody Fouch resigned from our Board. Mr. Terry Roussel who has served asresigned from our executive office positions of President and Chief Executive Officer, as well as from his role as director and Chairman of our Board, on September 18, 2012. Mr. Daniel Johnson succeeded Mr. Roussel as Chairman of Directors sincethe Board. As such, our inception in 2004. Ourcurrent Board of Directors is currently comprised of Mr. Rousseltwo members, Messrs. Johnson and twoDanchik, each of whom is an independent directors. director.

Our boardBoard composition and the corporate governance provisions set forth in our charter ensure strong oversight by independent directors. ThreeEach of the fourour Board’s standing committees of our Board of Directors areis currently chaired by, an independent director and our Audit, Compensation and Independent Directors Committees are comprised entirely of, independent directors. Although theBoard of Directors has not established a policy, one way or the other, on whether the role of the Chairman and Chief Executive Officer should be separated, in practice the Board has determined it would be preferable, at least for some period of Directors has foundtime, that having acombinedthe roles of Chairman and Chief Executive Officer role allows for more productive board meetings. be separated.As Chairman of the Board, of Directors, Mr. RousselJohnsonis responsible for chairing board meetings and meetings of shareholders,stockholders, setting the agendas for board meetings and providing information to the other directors in advance of meetings and between meetings.Mr. Roussel’s direct involvement in the company’s operations makes him best positioned to lead strategic planning sessions and determine the time allocated to each agenda item in discussions of our short- and long-term objectives. As a result, the Board of Directors currently believes that maintaining a structure that combines the roles of the Chairman and Chief Executive Officer is the appropriate leadership structure for our company. We do not currently have a policy requiring the appointment of a lead independent director.

The Role of the Board of Directors in our Risk Oversight Process

Management is responsible for the day-to-day management of risks that the companyCompany faces, while the Board, of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. The entire boardfull Board regularly reviews information regarding the company’sCompany’sliquidity, credit, operations and regulatory compliance, as well as the risks associated with each. The Audit Committee oversees risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Independent Directors Committee manages risks associated with the independence of the Board of Directors and potential conflicts of interest involving our sponsorAdvisor and its affiliates. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks as well as through regular reports directly from officers responsible for oversight of particular risks within the company.Company.

As a result of the departures of Messrs. Stedman, Fouch and Roussel from our Board during 2012, Messrs. Danchik and Johnson recognized certain challenges facing the Company and, together with the Advisor, conducted an exhaustive review of the Company’s business and prospects, including the evaluation of strategic alternatives. During this time, the Board determined to explore selling certain underperforming industrial properties, seeking to replace them with healthcare properties. Throughout the past year, Messrs. Danchik and Johnson met twice each week, evaluating alternatives and monitoring the Advisor’s progress with respect to this repositioning strategy. In recognition of these numerous meetings and the direct efforts of Messrs. Danchik and Johnson, the fees paid to them are higher in 2012 than in 2011. Messrs. Danchik and Johnson will continue to spend a significant amount of time in 2013 evaluating the Advisor’s progress and monitoring its effectiveness.

Director Independence

Our charter contains detailed criteria for determining the independence of our directors and requires a majority of the members of our Board of Directors to qualify as independent. The Board of Directors consults with our legal counsel to ensure that the board’sBoard’s independence determinations are consistent with our charter and applicable securities and other laws and regulations. Consistent with these considerations, after review ofreviewing all relevant transactions or relationships between each director, or any of his family members and Cornerstone Core Properties REIT,the Company, our senior management and our independent registered public accounting firm, the Board of Directors has determined that the majorityeach member of our Board of Directors is comprised of independent directors.has been determined to be independent. Furthermore, although our shares are not listed on a national securities exchange, a majorityour Board reasonably believes that each member of the members of our Board of Directors, and, allthus, each member of the members of ourBoard’s Audit Committee, Independent Directors Committee Compensation Committee and CompensationInvestment Committee are independent under the rules of the NASDAQ stock market.listing standards.

| 5 |

Nomination of Candidates for Director Positions

Nomination Process

We have determined that we are better served by generally having the full Board of Directors review director nominations. Therefore, we have no nominating committee; however, pursuant to our charter, our independent directors are responsible for nominating all replacements for vacancies resulting from the departure of independent directors. The full Board of Directors participates in the consideration of all other director nominees. Specifically, the Board of Directors identifies nominees by first evaluating the current members of the boardBoard willing to continue in service. Current members of the Board of Directors with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the Board of Directors upstanding for re-election at an upcoming annual meetingAnnual Meeting of stockholdersStockholders does not wish to continue in service, the Board of Directors identifies the desired skills and experience of a new nominee, if the Board of Directors determines that it is appropriate to replace the retiring member.nominee. The Board of Directors believes that potential directors should possess sound judgment, an understanding of the business issues affecting us, integrity and the highest personal and professional ethics. In searching for potential nominees, the Board of Directors (or the independent directors, if the nomination is for a vacant independent director position) seeks directors who have extensive relevant business, management and civic experience appropriate for assisting the Board of Directors to discharge its responsibilities. In the case of both incumbent and new directors, the Board of Directors seeks persons who are able tocan devote significant time and effort to board and committee responsibilities. In addition, when selecting new nominees for director positions, the Board of Directors seeks to develop and maintain a board that, as a whole, is strong in its collective knowledge and has a diversity of skills, background and experience with respect to accounting and finance, management and leadership, vision and strategy, business operations, industry knowledge and corporate governance.

The Board of Directors will consider recommendations made by stockholders for director nominees who meet the criteria set forth above. In order to be considered for nomination, recommendations made by stockholders must be submitted within the timeframe required to request a proposal to be included in the proxy materials. See “Stockholder“Additional Information – Stockholder Proposals” below.

Meetings of the Board of Directors and Committees

During the fiscal year ended December 31, 2011,2012, the Board of Directors met four times and took action by unanimous written consent one time.six times. During 2011,2012, each of our directors attended all of the meetings of the Board of Directors.Board. In addition, each director attended all of the meetings of the committees on which he served during 2011.2012. We encourage our directors to attend our annual meetingsAnnual Meetings of stockholders.Stockholders. All of our directors were present telephonically or in person at our 2011 annual meeting2012 Annual Meeting of stockholders.Stockholders. Our entire Board of Directors considers all majordecisions concerning our business, including any property acquisitions. However, our Board of Directors has established committees so that certain functions can be addressed in more depth than may be possible at a full board meeting. The Board of Directors has established four permanentstanding committees: the Audit Committee, the Independent Directors Committee, the Compensation Committee and the Investment Committee.

Audit Committee

The Audit Committee selects the independent public accountants tothat audit our annual financial statements, reviews the plans and results of the audit engagement with the independent public accountants, approves the audit and non-audit services provided by the independent public accountants, reviews the independence of the independent public accountants, considers the range of audit and non-audit fees and reviews the adequacy of our internal accounting controls. The current members of the Audit Committee are Paul Danchik and Daniel Johnson. Until his resignation on April 2, 2012, Jody Fouch servedDaniel Johnson serves as the Chairman of the Audit Committee and satisfiedsatisfies the SEC’s requirements forof an “audit committee financial expert.” The independent directors are currently considering candidates to fill the vacancy on the Audit Committee caused by Mr. Fouch’s resignation. During the fiscal year ended December 31, 2011,2012, the Audit Committee met four times. The Audit Committee has adoptedapproved and re-adopted a charter, which wasis included asAppendix A to the proxy materials relating to our 2010 annual meeting of stockholders.this Proxy Statement.

Independent Directors Committee

In order to reduce or eliminate certain potential conflicts of interest, a majority of our independent directors that is,(i.e., the directors who are not affiliated with our advisor, approvesAdvisor) approve all transactions between usthe Company and our advisorAdvisor or its affiliates. See “Certain Transactions with Related Persons” below for a discussion of the transactions considered and approved by our Independent Directors Committee since the beginning of 2011.2012. Our independent directors are authorized to retain their own legal and financial advisors at our expense and are empowered to act on any matter permitted under Maryland law provided that a majority of our independent directors first determine that the matter at issue is such that the exercise of independent judgment by our advisorAdvisor could reasonably be compromised. Any conflict-of-interest matters that cannot be delegated to a committee under Maryland law must be acted upon by both the full Board of Directors and a majority of our independent directors. The current members of the Independent Directors Committee are Daniel Johnson (Chairman) and Paul Danchik. During the fiscal year ended December 31, 2011,2012, the Independent Directors Committee met 2183 times.

| 6 |

Compensation Committee

Our Compensation Committee discharges the board’sBoard’s responsibilities relating to compensation of our executives.executive officers. The Compensation Committee administers the granting of stock options to our advisor,Advisor, selected employees of our advisorAdvisor and its directors, officers and affiliates based upon recommendations from our advisorAdvisor and sets the terms and conditions of such options in accordance with our Employee and Director Incentive Stock Plan (the “Incentive Stock Plan”), which we describe further below. Our Compensation Committee also has authority to amend the Employee and Director Incentive Stock Plan or create other incentive compensation and equity-based plans. The current members of the Compensation Committee are Paul Danchik (Chairman) and Daniel Johnson. The Compensation Committee met one time during the fiscal year ended December 31, 2011.2012. The Compensation Committee has adopted a charter, which was included as Appendix A to the proxy materials relating to our 2011 annual meetingAnnual Meeting of stockholders.Stockholders.

Investment Committee

Our Investment Committee’s basic responsibility is to review the real estate investments proposed to be made by us, including investments in real estate through joint ventures, and to confirm that the real estate investments selected by our management are consistent with the investment limitations set forth in our charter and consistent with our acquisition policies, our primary investment focus, property selection criteria and conditions to closing. Our Investment Committee must consist of at least three directors, a majority of whom are “independent directors” as defined in our charter. The current memberscurrently consists of our Investment Committee are all of the members of our board.two independent directors: Paul Danchik (Chairman) and Daniel Johnson. During the fiscal year ended December 31, 2011,2012, the Investment Committee met fivefour times.

Communication with Directors

We have established procedures for stockholders or other interested parties to communicate directly with our Board of Directors.Board. Such parties can contact the Board of Directors by mail at: Chairperson of the Audit Committee of Cornerstone Core Properties REIT, Inc., 1920 Main Street, Suite 400, Irvine, CA 92614. The Chairperson of the Audit Committee will receive all communications made by this means.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics that is applicable to all members of our Board of Directors and our executive officers. The Code of Business Conduct and Ethics can be accessed through our website: www.crefunds.com. If, in the future, we amend, modify or waive a provision in the Code of Business Conduct and Ethics, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website.

Executive Officers

In addition to Terry Roussel,July 2012, Mr. Kent Eikanas was appointed as of March 29,2012, the following individual currently serves as an executive officer:

Stephen I. Robie, age 43, joined the Company in December 2011 as Chief Financial Officer, Treasurer, and Secretary. Mr. Robie also serves as theour Chief Operating Officer and, thereafter, succeeded Mr. Terry Roussel as our President on September 18, 2012. Mr. Stephen I. Robie was removed from his position of Chief Financial Officer on June 15, 2012 and replaced by Mr. Timothy C. Collins on August 1, 2012. Biographical information of Mr. Kent Eikanas and Mr. Timothy C. Collins are set forth below:

Kent Eikanas, age 43, currently serves as the Company’s President and Chief Operating Officer as well as President and Chief Operating Officer of Healthcare Real Estate Group, of Cornerstone Ventures, Inc., an affiliate of our advisor, and has held these positions since August 2011. Mr. Robie has over twenty years of global real estate finance experience managing the financial operations of both high-growth, high-profit S&P 500 corporations and start-up, entrepreneurial ventures.Advisor. From 2008 to August 2011,2012, Mr. Robie founded andEikanas served as managing partnerVice President of SIR Holdings, LLC, an entrepreneurial investment firm with focus on venture capital,Senior Housing for Granite Investment Group (“Granite”), where he closed over $100 million in senior housing real estate refinances, dispositions and management consulting.acquisitions. In addition, Mr. Eikanas managed over $700 million in senior housing assets. Mr. Eikanas was a key contributor to the launch of a skilled nursing operating company based in Dallas, Texas, while at Granite and helped the operating company grow from 14 facilities to 35 facilities. From 20042003 to 2008, Mr. Robie served as SeniorEikanas was the Vice President of Finance at HCP, Inc., an S&P 500 healthcareAcquisitions for a private real estate investment trust.company and closed over $200 million in senior housing real estate. Mr. Eikanas has overseen licensing for skilled nursing facilities, assisted living facilities and memory care facilities in California, Texas, Rhode Island, Oregon and Pennsylvania. From 19971999 to 2004,2003, Mr. RobieEikanas worked for General Electric Companyin sales and its commercial real estate division, GE Real Estate, where he served as Manager of Finance for GE Real Estate’s North America Equity Investments. Prior to his affiliation with General Electric Company,REMAX. Mr. Robie spent six years in public accounting at Arthur Andersen LLP, including serving as a manager for private and publicly-traded real estate companies. Mr. RobieEikanas graduatedmagna cum laude from California State University Sacramento with a Bachelor of Arts Degree in Economics from Tufts University in 1990 and earned a Masters of Business Administration Degree, with Distinction, in Finance and Accounting from the Stern School of Business at New York University. Mr. Robie is also a Certified Public AccountantPsychology and a minor in Business Administration.

Timothy C. Collins, age 65, serves as the Company’s Chief Financial Officer. Since 1987, Mr. Collins has served as a principal at T.C. Collins and Associates, Inc., a real estate development strategic consulting firm, overseeing such firm’s property management of 1.1 million square feet of multi-tenant, commercial/industrial properties. Prior to founding T.C. Collins and Associates, Mr. Collins served as chief financial officer of two public companies from 1975 to 1985, and worked in public accounting as a licensed CPA from 1970 through 1975. Mr. Collins serves on the board of directors of Instamed Holdings, a medical technology company and is a volunteer member and chairman of the AICPA.board of trustees of the Explore Ocean/Newport Harbor Nautical Museum. From 2003 to 2011, Mr. Collins served on the advisory board of Cornerstone Realty Fund, an affiliate of our Advisor.

| 7 |

Executive Compensation

Our executive officers do not receive compensation directly from usthe Company for services rendered to us. Ourthe Company. Because our executive officers, except for Mr. Collins, are also officers ofCornerstone Realty Advisors, LLC, our advisorAdvisor, and its affiliates, andthey are compensated by these entities,Advisor and its affiliates, in part, for their services to us. Mr. Collins is also compensated by Advisor for his services to us. Under the terms of the advisory agreement between our advisorAdvisor and the Company (the “Advisory Agreement”), our Advisor is responsible for providing our day-to-day management, subject to the authority of our Board of Directors.Board.A description of the fees that we pay to our advisorAdvisor and its affiliates is found under “Certain Transactions with Related Persons” below.Pursuant to the advisory agreement,Advisory Agreement, we reimburse our advisorthe Advisor for expenses incurred on our behalf, which expenses include salary reimbursements for the portion of Mr. Roussel’s and Mr. Robie’sour executive officers’ salaries allocated to us for their services to us related to our operations.

The following table shows the summary compensation reimbursements we have made to our advisorAdvisor or its affiliates for the compensation of Mr. Roussel and Mr. Robieour executive officers allocated to us for the past three years.

| Name and Principal Position | Year | Salary(1) | Bonus | Total | ||||||||||||

| Terry G. Roussel | 2011 | $ | 214,000 | $ | — | $ | 214,000 | |||||||||

| President and Chief Executive Officer | 2010 | 244,000 | — | 244,000 | ||||||||||||

| 2009 | 137,000 | — | 137,000 | |||||||||||||

| Stephen I. Robie | 2011 | $ | 84,000 | $ | — | $ | 84,000 | |||||||||

| Chief Financial Officer, Treasurer and | 2010 | N/A | N/A | N/A | ||||||||||||

| Secretary(2) | 2009 | N/A | N/A | N/A | ||||||||||||

| Sharon C. Kaiser | 2011 | $ | 131,000 | $ | — | $ | 131,000 | |||||||||

| Chief Financial Officer, Treasurer and | 2010 | 155,000 | — | 155,000 | ||||||||||||

| Secretary(3) | 2009 | 151,000 | — | 151,000 | ||||||||||||

| Name and Principal Position | Year | Salary(1) | Bonus | Total | ||||||||||||

| Terry G. Roussel | 2012 | $ | 234,000 | $ | — | $ | 234,400 | |||||||||

| Former President and Chief Executive | 2011 | $ | 214,000 | $ | — | $ | 214,000 | |||||||||

| Officer(2) | 2010 | 244,000 | — | 244,000 | ||||||||||||

| Stephen I. Robie | 2012 | $ | 84,000 | $ | — | $ | 84,000 | |||||||||

| Former Chief Financial Officer, Treasurer | 2011 | $ | 84,000 | $ | — | $ | 84,000 | |||||||||

| and Secretary(3) | 2010 | — | — | — | ||||||||||||

| Kent Eikanas | 2012 | $ | 20,000 | $ | — | $ | 20,000 | |||||||||

| President and Chief Operating Officer(4) | 2011 | — | — | — | ||||||||||||

| 2010 | — | — | — | |||||||||||||

| Timothy C. Collins | 2012 | $ | 80,085 | $ | — | $ | 80,085 | |||||||||

| Chief Financial Officer, Treasurer | 2011 | — | — | — | ||||||||||||

| 2010 | — | — | — | |||||||||||||

| (1) | Reimbursements for our executive officers salaries include a 7% surcharge intended to cover our allocable portion of such executive officers benefits and payroll expenses and taxes paid by our Advisor and its affiliates. |

| (2) | Resigned effective September 18, 2012. |

| (3) | Removed effective June 15, 2012. |

| (4) | Appointed Chief Operating Officer, effective |

| (5) | Appointed effective August 1, 2012. Mr. Collins reports directly to the Independent Directors of the Board. The amounts shown reflect consultation service fees and reimbursements made by our Advisor or its affiliates. |

Director Compensation

IfAs mentioned above, due to the departures of Messrs. Stedman, Fouch and Roussel from our Board, during 2012 Messrs. Danchik and Johnson recognized certain challenges facing the Company and, together with the Advisor, conducted an exhaustive review of the Company’s business and prospects, including the evaluation of strategic alternatives. During this time, the Board determined to explore selling certain underperforming industrial properties, seeking to replace them with healthcare properties. Throughout the past year, Messrs. Danchik and Johnson have met twice each week, evaluating alternatives and monitoring the Advisor’s progress with respect to this repositioning strategy. In recognition of these numerous meetings and the direct efforts of Messrs. Danchik and Johnson, the fees paid to them are higher in 2012 than it was in 2011. Messrs. Danchik and Johnson will continue to spend a significant amount of time in 2013 evaluating the Advisor’s progress and monitoring its effectiveness.

In the event a director is also one of our executive officers, we do not pay any compensation for services rendered as a director. The amount and form of compensation payable to our independent directors for their service to us is determined by our Board, of Directors, based upon information provided by our Advisor. Our Chief Executive Officer, Mr. Roussel, manages and controls our advisor, and through the advisor, he has been involved in advising on the compensation to be paid to our independent directors.

We have provided below certain information regarding compensation paid to our directors during fiscal year 2011.

| Name | Fees Earned or Paid in Cash | |||

| Terry Roussel(1)(2) | $ | — | ||

| Paul Danchik | $ | 118,480 | ||

| Daniel Johnson | $ | 139,390 | ||

| Jody Fouch(3) | $ | 21,500 | ||

| Lee Powell Stedman(4) | $ | — | ||

| Name | Fees Earned or Paid in Cash | |||

| Terry Roussel(1) | $ | — | ||

| Paul Danchik | $ | 63,250 | ||

| Jody Fouch(2) | $ | 65,000 | ||

| Daniel Johnson | $ | 68,000 | ||

| Lee Powell Stedman(3) | $ | 64,250 | ||

| (1) | Directors who are also our executive officers do not receive compensation for services rendered as a director. |

| (2) |

| (3) | Mr. Fouch resigned from the Board, effective April 2, 2012. |

During the 20112012 fiscal year, we paid each of our independent directors quarterly retainers as follows: $6,250 in the first quarter, $5,000 in the second quarter, $3,750 in the third quarter and $2,500 in the fourtha retainer of $2,500.00 per quarter. For the 20122013 fiscal year we intend to continue to pay each of our independent directors a quarterly retainer of $2,500.$2,500.00 per quarter. In addition, we pay independent directors for attending board and committee meetings as follows:

| · | $3,000 per regular board meeting attended in person or by teleconference. We expect to hold four regular board meetings per year. |

| · | $750 per special board meeting attended in person or by teleconference. The special board meeting fee will apply to any board meeting called by our executive officers that is not a regular board meeting. |

| · | $1,000 per committee meeting attended. |

| · | An additional committee chair fee of $500 per meeting for the chair of the Audit Committee. |

| · | An additional committee chair fee of $250 per meeting for the respective chairs of the Compensation, Investment and Independent Directors Committees. |

All directors receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of the Board of Directors and committees.

Employee and Director Incentive AwardStock Plan

We have adopted an EmployeeIncentive Stock Plan which provides for the grant of awards to directors, full-time employees, and Directorother eligible participants that provide services to us. We have no employees, and we do not intend to grant awards under the Incentive Stock Plan to persons who are not directors. Awards granted under the Incentive Stock Plan may consist of nonqualified stock options, incentive stock options, restricted stock, share appreciation rights, and distribution equivalent rights. The total number of shares of common stock reserved for issuance under the Incentive Stock Plan is equal to 10% of our outstanding shares of stock at any time. Outstanding stock options became immediately exercisable in full on the grant date, will expire ten years after their grant date, and had no intrinsic value as of December 31, 2012.

We have adopted an Incentive Stock Plan to: (i) provide incentives to individuals who are granted stock awards because of their ability to improve our operations and increase profits; (ii) encourage selected persons to accept or continue employment with us or with our Advisor or its affiliates; and (iii) increase the interest of directors in our success through their participation in the growth in value of our stock.

In connection with the registration of our follow-on public offering, which is currently suspended,has been terminated, we have undertaken not to issue optionsawards to our independent directors, either pursuant to the Employee and Director Incentive Stock Plan or any successor plan, unless we also make options available to the public on the same terms. We have no timetable for the grant of any further awards under the Employee and Director Incentive Stock Plan.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is a current or former executive officer or employee of our company.

Equity Compensation Plan Information

The following table gives information about our common stock that may be issued upon the exercise of the options under all of our existing equity compensation plans as of December 31, 2011:2012:

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance | |||||||

| Equity compensation plans approved by security holders | 65,000 | $ | 8.00 | See footnote (1) | ||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||

| Total | 65,000 | $ | 8.00 | See footnote (1) | ||||||

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance | |||||||||

| Equity compensation plans approved by security holders | 40,000 | (1) | $ | 8.00 | See footnote (2) | |||||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||

| Total | 40,000 | (1) | $ | 8.00 | See footnote (2) | |||||||

| (1) |

| (2) | Our Incentive Stock Plan was approved by our security holders and provides that the total number of shares issuable under |

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board, of Directors, which is responsible for discharging the board’sBoard’s responsibilities relating to the compensation of our directors and would be expected to act upon matters of executive compensation as necessary has reviewed and discussed the executive compensation disclosure required by Item 402(b) of Regulation S-K with management and, in reliance on these reviews and discussions, the Compensation Committee recommended to the Board, of Directors, and the boardBoard approved, the inclusion of such disclosure in this Proxy Statement.

| The Compensation Committee of the Board of Directors | |

| Paul Danchik (Chairman) and Daniel Johnson |

OWNERSHIP OF EQUITY SECURITIES

The following table sets forth information as of March 29,2012,April 1, 2013, the Record Date, regarding the beneficial ownership of our common stock by each person known by us to own 5% or more of the outstanding shares of common stock, each of our directors, each of our named executive officers, and our directors and executive officers as a group. The percentage of beneficial ownership is calculated based on 23,028,285 shares of common stock outstanding as of March 29, 2012.the Record Date.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percentage

| ||||||

| Terry G. Roussel | 125 | * | ||||||

| Stephen I. Robie | ||||||||

| Kent Eikanas | None | * | ||||||

| Timothy Collins | None | * | ||||||

| Paul Danchik(2) | 20,000 | * | ||||||

| Daniel Johnson(2) | 20,000 | * | ||||||

| All current directors and executive officers as a group | * | |||||||

| * | Less than 1%. |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities and shares issuable pursuant to options, warrants and similar rights held by the respective person or group that may be exercised within 60 days following |

| (2) | Consists of shares of common stock underlying options that are immediately exercisable. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”“Exchange Act”), requires each director, officer and individual beneficially owning more than 10% of a registered security of us to file initial statements of beneficial ownership (Form 3) and statements of changes in beneficial ownership (Forms 4 and 5) of common stock of us with the SEC.BasedSEC.Based solely upon our review of copies of these reports filed with the SEC and written representations furnished to us by our officers and directors, we believe that all of the persons subject to the Section 16(a) reporting requirements filed the required reports on a timely basis with respect to fiscal year 2011.2012.

AUDIT COMMITTEE REPORT

The Audit Committee reviews our financial reporting process on behalf of the Board of Directors.Board. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm regarding the fair and complete presentation of our results. The Audit Committee has discussed significant accounting policies applied by us in our financial statements, as well as alternative treatments. Management of the Advisor represented to the Audit Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

In addition, the Audit Committee has discussed with the independent registered public accounting firm its independence from us and our management, including the matters in the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the accountant’s communications with the Audit Committee concerning independence. The Audit Committee also has considered whether the independent registered public accounting firm’s provision of non-audit services to us is compatible with its independence. The Audit Committee has concluded that the independent registered public accounting firm is independent from us and our management.

The Audit Committee discussed with our independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its examination, the evaluation of our internal controls, and the overall quality of our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, of Directors, and the Board has approved, that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011,2012, for filing with the SEC. The Audit Committee has selected our independent registered public accounting firm. The following directors, who constitute the Audit Committee, provide the foregoing report.

| The Audit Committee of the Board of Directors | |

The foregoing report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act, of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such Acts.

Independent Registered Public Accounting Firm

Deloitte and Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”), have served as our independent registered public accounting firm since January 16, 2006 and have audited our financial statements for the years ended December 31, 2012, 2011 2010 and 20092010. We expect that our Audit Committee will engage Deloitte & Touche as our independent auditor to audit our financial statements for the year ended December 31, 2012. Our management believes that they areDeloitte & Touche is knowledgeable about our operations and accounting practices and areis well qualified to act as our independent auditor.

One or more representatives of Deloitte & Touche are expected to be present at the annual meeting. They will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Audit and Non-Audit Fees

The following table lists the fees for services rendered by Deloitte & Touche for 20112012 and 2010:2011:

| Services | 2011 | 2010 | ||||||

| Audit Fees(1) | $ | 329,000 | $ | 326,000 | ||||

| Tax Fees(2) | 49,000 | 45,000 | ||||||

| Total | $ | 378,000 | $ | 371,000 | ||||

| Services | 2012 | 2011 | ||||||

| Audit Fees(1) | $ | 523,000 | $ | 329,000 | ||||

| Tax Fees(2) | 55,000 | 49,000 | ||||||

| Total | $ | 578,000 | $ | 378,000 | ||||

| (1) | Audit fees billed in |

| (2) | Tax services billed in |

The Audit Committee pre-approves all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our independent auditor, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act and the rules and regulations of the SEC which are approved by the Audit Committee prior to the completion of the audit.

CERTAIN TRANSACTIONS WITH RELATED PERSONS

The Independent Directors Committee has reviewed the material transactions between our affiliates (including the Advisor) and usthe Company since the beginning of 20112012 as well as any such currently proposed transactions. Set forth below is a description of such transactions.

| 12 |

Our Relationships with our Advisor and Dealer Manager

Cornerstone Industrial Properties, LLC is the sole member of our advisor,Advisor, Cornerstone Realty Advisors, LLC. Cornerstone Ventures, Inc. is the managing member ofCornerstone Industrial Properties, LLC. Terry G. Roussel, our former Chairman, President and Chief Executive Officer, and President, is the Chief Executive Officer and a Director of our advisor, as well as the President, Chief Executive Officer, a Director and the majority shareholder of Cornerstone Ventures, Inc. Mr. Roussel is also the majority shareholder of Pacific Cornerstone Capital, Inc., the dealer manager for our ongoing follow-on public offering. Alfred J. Pizzurro, formerly our Senior Vice President and Secretary, is also a shareholder of Pacific Cornerstone Capital, Inc. and Cornerstone Ventures, Inc.

We pay fees to our advisor for services provided to us pursuant to an advisory agreement and we pay fees and commissions to Pacific Cornerstone Capital, Inc. the dealer manager for our ongoing follow-on public offering pursuant to a dealer manager agreement. The fees that we will pay to our advisor and dealer managerAdvisor are summarized below.

Offering Stage Fees and Expenses:Expenses.Reimbursements to our Advisor or its affiliates for organization and offering expenses (including bona fide due diligence expenses) were expected to be approximately 2% of gross offering proceeds from our initial public offering if we had raised the maximum offering, but could be as much as 3.5%.

| · | During the fiscal year ended December 31, |

| · | During the year ended December 31, |

Acquisition and Operating Stage Fees and Expenses:Expenses

| · | Property acquisition fees (payable to our |

| · | Reimbursement of acquisition expenses to our |

| · | Property management and leasing fees. If Advisor or its affiliates provides property management or leasing services with respect to any of the properties held by the Company, the Company will pay the Advisor or its affiliates a market-based fee which is no greater than what other management or leasing companies generally charge for the management or leasing of similar properties, which may include reimbursement for the costs and expenses the Advisor or its affiliates incurs in managing or leasing such properties, provided however, that in no event shall, (i) the amount of the monthly property management fee payable with respect to a property exceed 3.0% of the monthly gross revenue of such property, and (ii) the amount of the leasing fee payable with respect to a lease at a property exceed 2.5% of the rent under such lease for the initial term. Any property management fee payable to Advisor shall by paid by the Company monthly upon receipt by the Company of the written notice of the amount of the property management fee accompanied by a computation of such fee. Any leasing fee payable to the Advisor shall be paid by the Company in full upon the execution of the applicable lease following receipt of written notice by the Company of the amount of the leasing fee, accompanied by a computation of such fee. |

| · | Monthly asset management fees (payable to our |

| · | Reimbursement of operating expenses including our |

| · | During the fiscal year ended December 31, |

| · | During the year ended December 31, |

| · | For the year ended December 31, |

| · | For the year ended December 31, 2012 property management fees actually paid was $40,000. |

| · | For the year ended December 31, 2012, leasing fees actually paid was $1.4 million. |

Listing/Liquidation Stage Fees and Expenses:

| · | Property disposition fees (payable to our |

| · | After stockholders have received cumulative distributions equal to $8 per share (less any returns of capital) plus cumulative, non-compounded annual returns on net invested capital, our |

| · | Upon termination of the |

| · | In the event we list our stock for trading, our |

| · | During the year ended December 31, |

| · | During the year ended December 31, |

Other Transactions involving Affiliates

Sherburne Commons Mortgage Loan.

On December 14, 2009, through a wholly-owned subsidiary, we made a participating first mortgage loan commitment of $8.0 million to Nantucket Acquisition LLC, a Delaware limited liability company managed by Cornerstone Ventures, Inc., an affiliate of our advisor,Advisor, in connection with Nantucket Acquisition LLC’s purchase of a 60-unit senior living community known as Sherburne Commons located on the exclusive island of Nantucket, MA.MA (“Sherburne Commons”). We refer to this mortgage loan as the “senior loan.“senior loan.” TheAt the time, the terms of the senior loan were approved by our Board, of Directors, including a majority of our independent directors, not otherwise interested in the transaction, as being (i) consistent with our charter imposed limitations on mortgage loans involving affiliates of our sponsor and (ii) fair, competitive and commercially reasonable and on terms no less favorable to us than loans between unaffiliated parties under the same circumstances. We received a loan origination fee of 1.0% upon the closing of the senior loan.

The senior loan matures on January 1, 2015, with no option to extend and bears interest at a fixed rate of 8.0% for the term of the loan. In addition, under the terms of the senior loan, we are entitled to receive additional interest in the form of a 40% participation in the “shared appreciation”“shared appreciation” of the property, which is calculated based on the net sales proceeds if the property is sold, or the property’s appraised value, less ordinary disposition costs, if the property has not been sold by the time the senior loan matures. Prepayment of the senior loan is not permitted without our consent and the loan is not assumable.

Nantucket Acquisition LLC acquired the Sherburne Commons, property that was builtwhich constructed at a construction cost of approximately $33.0 million, for an initial price of $6.0 million plus a commitment to fund certain closing costs and working capital requirements that will bring the total transaction cost to $9.5 million over time. In connection with the closing of the acquisition, Nantucket Acquisition LLC drew approximately $6.5 million of the proceeds from the senior loan. The remaining $1.5 million was drawn as needed during 2009 and 2010. Leasing activity at Sherburne Commons has been lower than originally anticipated resulting in operating shortfalls at the facility.During 2011, the loan balance was increased by $0.5 million to provide funds to meet Sherburne Commons’ operating shortfalls. As of October 2011, we reclassified the property as held for sale. In the first quarter of 2012, we recorded a $1.1 million impairment related to Nantucket Acquisition, LLC, as a result of receiving an offer to purchase the property.

In connection with the acquisition of the property,Sherburne Commons, Cornerstone Healthcare Real Estate Fund, Inc. (formerly Cornerstone Private Equity Fund, Inc.), a private real estate fund managed by affiliates of our advisor,Advisor, also made a loan commitment to Nantucket Acquisition LLC of up to $1.5 million, to be drawn as necessary, secured by a second mortgage on the property.Sherburne Commons. We refer to this mortgage loan as the “junior loan.“junior loan.” We refer to our senior loan and the junior loan from Cornerstone Healthcare Real Estate Fund, Inc. collectively as the “loans.“loans.” As of December 31, 2011,2012, the aggregate outstanding loan balance of the loans was $1.3 million.million and was fully reserved.

Other members of Nantucket Acquisition LLC affiliated with us are our Advisor, Cornerstone Ventures, Inc.; our advisor, Cornerstone Realty Advisors, LLC;, Cornerstone Leveraged Realty Advisors, LLC;LLC, and Cornerstone Healthcare Real Estate Fund, Inc. Cornerstone Ventures, Inc. is owned and controlled by Terry G. Roussel, who is also our former President and Chief Executive Officer and a member of our Board of Directors.Officer. Mr. Roussel is also a director and officer of Cornerstone Realty Advisors, LLC,our Advisor, Cornerstone Leveraged Realty Advisors, LLC and Cornerstone Healthcare Real Estate Fund, Inc. Stephen Robie, who is our Chief Financial Officer, Treasurer and Secretary is an officer of Cornerstone Realty Advisors, LLC.Inc

Under the Nantucket Acquisition LLC’s operating agreement, our affiliates of ours will share in the operating cash flow and “shared“shared appreciation,” as defined above, from the propertySherburne Commons as follows. With respect to operating cash flow, (i) prior to the payment in full of amount due on the loans, operating cash flow will first be distributed to us and then to Cornerstone Healthcare Real Estate Fund, Inc. until the loans are paid in full, and (ii) after the loans are paid in full, remaining operating cash flow will be distributed to Cornerstone Ventures, Inc. With respect to the shared appreciation in the property, (i) prior to the payment in full of the loans, shared appreciation is divided as follows: 40% to us, 10% to Cornerstone Healthcare Real Estate Fund, Inc., 14.03% to Cornerstone Realty Advisors, LLC,our Advisor, 2.63% to Cornerstone Leveraged Realty Advisors, LLC and 33.34% to Servant Healthcare Investments, LLC, an unaffiliated party, (ii) after the loans are paid in full, 50% to Cornerstone Ventures, Inc., 14.03% to Cornerstone Realty Advisors, LLC,our Advisor, 2.63% to Cornerstone Leveraged Realty Advisors and 33.34% to Servant Healthcare Investments, LLC.

On a quarterly basis, we evaluate the collectability of our notes receivable from related parties. Our evaluation of collectability involves judgment, estimates, and a review of the underlying collateral and borrower’s business models and future cash flows. For the years ended December 31, 2012, 2011, and 2010, we did not record any impairment on the note receivable from related party.

Leasing activity at Sherburne Commons has been lower than originally anticipated and to preserve cash flow for operating requirements, the borrower suspended interest payments to us beginning in the first quarter of 2011. Consequently, we began recognizing interest income on a cash basis commencing in the first quarter of 2011. For the years ended December 31, 2012, 2011, and 2011, interest income recognized on the note was $0, $55,000, and $628,000, respectively.

In the second quarter of 2011, the loan balance was increased by $0.3 million to provide funds to meet Sherburne Commons’ operating shortfalls. In the fourth quarter of 2011, we provided an additional $0.2 million in funding. As of October 2011, we reclassified the property as held for sale.

Nantucket Acquisition LLC is considered a variable interest entity (“VIE”) because the equity owners of Nantucket Acquisition LLC do not have sufficient equity at risk, and our mortgage loan commitment was determined to be a variable interest. Due to the suspension of interest payments by the borrower, we issued a notice of default to the borrower on June 30, 2011 and determined that we are the primary beneficiary of the VIE due to our enhanced ability to direct the activities of the VIE. The primary beneficiary of a VIE is required to consolidate the operations of the VIE. Consequently, we have consolidated the operations of the VIE as of June 30, 2011 and, accordingly, eliminated the note receivable from related party balance in consolidation.

OfficerHealthcare Properties. On June 11, 2012, we formed Cornerstone Healthcare Partners LLC (“CHP LLC”), a Delaware limited liability company, to purchase healthcare related properties. As of December 31, 2012, we owned approximately 95% of CHP LLC while Cornerstone Healthcare Real Estate Fund, Inc., an affiliate of our Advisor, owned approximately 5%. During the second half of 2012, we acquired, through CHP LLC, the five healthcare properties described below. Because CHP LLC’s equity holders have voting rights disproportionate to their economic interests in the entity, CHP LLC is considered to be a VIE. We have a controlling financial interest in CHP LLC because we have the power to direct the activities of the VIE that most significantly impact its economic performance and Director Indemnification Agreementswe have the obligation to absorb the VIE’s losses and the right to receive benefits from the VIE. Consequently, we are deemed to be the primary beneficiary of the VIE and, therefore, have consolidated the operations of the VIE beginning in the third quarter of 2012. Assets of the VIE may only be used to settle obligations of the VIE and creditors of the VIE have no recourse to the general credit of the Company.

Portland, Oregon Properties (Sheridan and Fernhill)

On August 3, 2012, through CHP LLC, we acquired two skilled nursing facilities located in the Portland, Oregon metropolitan area for a purchase price of $8.6 million. 411 SE Sheridan Road (“Sheridan”), located approximately fifty miles southwest of Portland in Sheridan, Oregon, is a 51-bed intermediate care facility with a current occupancy of approximately 81%. This 13,912 square foot single-story facility was constructed in multiple phases between 1960 and 1970. 5737 NE 37th Avenue (“Fernhill”), located in Portland, Oregon, is a 13,344 square foot, originally constructed to be a 51-bed facility with current occupancy of approximately 72%. This facility was built in 1960 and has obtained approval to expand to 63 beds. The operator of the Sheridan and Fernhill properties has served in such capacity since 2005, has over twenty years of experience operating skilled nursing facilities in the Pacific Northwest and is operating the properties under new long-term, triple-net leases.

Medford, Oregon

On September 14, 2012, through CHP LLC, we acquired Farmington Square Medford, a memory care facility with 52 units and 71 licensed beds in Medford, Oregon (“Medford”), for a purchase price of $8.5 million. The facility, consisting of four separate wood-framed, single-story buildings totaling 32,557 square feet, was constructed in phases between 1990 and 1997 and currently operates at approximately 90% occupancy. The operator of the Medford property has served in that capacity since 1991, has over twenty years of experience operating senior-living facilities in the Pacific Northwest and is operating the facility under a new long-term, triple-net lease.

Galveston, Texas

On September 14, 2012, through CHP LLC, we acquired Friendship Haven Healthcare and Rehabilitation Center, a skilled-nursing facility with 150 licensed beds located in Galveston County, Texas (“Galveston”), for a purchase price of $15.0 million. The facility, a single-story, 53,826 square foot wood-frame building, was constructed in 1997 and currently operates at 90% occupancy. The manager of the Galveston property has served in that capacity since February 2012, has over twenty years of experience operating senior-living facilities in Texas and Louisiana and is operating the Galveston facility under a new long-term, triple-net lease.

Tigard, Oregon

On December 29, 2011,21, 2012, through CHP LLC, we entered into indemnification agreements with eachacquired, through the exercise of an option that was assigned to us by Pacific Gardens Real Estate LLC, the membersPacific Health & Rehabilitation skilled-nursing facility (“Pacific”) located in Tigard, Oregon for $8.1 million. Pacific, located at 14145 SW 105th Street, Tigard, Oregon has an operational capacity of our Board of Directors and each person holding office as an officer of78 beds. Pacific is being leased to the company, with the exception in each case of Terry Roussel, who elected notcurrent operator pursuant to execute an indemnification agreement.a long-term triple-net lease.

We have agreed to indemnify and advance certain expenses to the indemnitees as provided in the indemnification agreements and as otherwise permitted by Maryland law. We have agreed to indemnify the indemnitees against all judgments, penalties, fines and amounts paid in settlement and all expenses actually and reasonably incurred by him or her on his or her behalf in connection with any proceeding unless it is established by clear and convincing evidence that (a) the act or omission of the indemnitee was material to the matter giving rise to the proceeding and (i) was committed in bad faith or (ii) was the result of active and deliberate dishonesty, (b) the indemnitee actually received an improper personal benefit in money, property or services, or (c) in the case of any criminal proceeding, the indemnitee had reasonable cause to believe that his or her conduct was unlawful.

Consistent with the requirements of our charter, we will not indemnify an indemnitee for any loss or liability unless all of the following conditions are met: (i) the indemnitee has determined, in good faith, that the course of conduct that caused the loss or liability was in the best interests of the company; (ii) the indemnitee was acting on behalf of or performing services for the company; (iii) with respect to the independent directors, such loss or liability was not the result of gross negligence or willful misconduct and with respect to the officers, such loss or liability was not the result of negligence or misconduct; and (iv) such indemnification is recoverable only out of the company’s net assets and not from the company’s stockholders, investors or stakeholders.

Furthermore, we will not indemnify an indemnitee:

We will not indemnify or advance expenses if a proceeding was brought by an indemnitee, unless: (i) the proceeding was brought to enforce indemnification under the indemnification agreement, and then only with certain limitations, or (ii) our charter or bylaws, a resolution of the stockholders, or an agreement approved by the Board of Directors to which the company is a party, expressly provides otherwise.

If an indemnitee is, or is threatened to be, made a party to any proceeding, we will, without requiring a preliminary determination of his or her ultimate entitlement to indemnification, advance all reasonable expenses incurred by or on behalf of him or her in connection with certain proceedings and which relates to acts or omissions with respect to the performance of duties or services on behalf of the company. Such advance or advances will be made within ten days after the receipt by the company of a statement or statements requesting such advance or advances from time to time, whether prior to or after final disposition of such proceeding. Such statement or statements will reasonably evidence the expenses incurred by the indemnitee and will include or be preceded or accompanied by a written affirmation by the indemnitee of his or her good faith belief that the standard of conduct necessary for indemnification has been met and there has been a written undertaking by or on behalf of the indemnitee.